As a credit card user for more than four years now, I’m pretty aware of the freedom it gives and the risk it gives rise to. A credit card is a boon but only until you keep paying entire bills promptly. Once you skip the due date, the high-interest rates come into play, taking away all the benefits you ever fetched. But, coming across Uni Credit Card and understanding this product undoubtedly changed my many beliefs about credit card usage.

What is Uni Pay 1/3rd Card?

The concept of Uni Credit is certainly unique at its best. Uni has brought this card in a partnership with SBM India, an Indian subsidiary of SBM (State Bank of Mauritius). Uni Card targets mainly those users who want to get relief from monthly credit card bills. That may include young tech-savvy customers or people with a lower salary but higher spending habits. If you apply for the card before 31st January 2022, you don’t have to pay any annual charges for a lifetime.

1/3rd Payment Credit Card. What’s this?

So now, let’s come to the central question of what makes the Uni Card appealing? The biggest USP is that it allows a credit period of 3 months instead of just a month. You spend whatever you want and pay 1/3rd of your spending on the billing date for three months. E.g., If your credit card bill is INR 30,000, you can pay INR 10,000 for three months each. The best part is that it doesn’t invite any interest or hidden charges.

Just in case you want to pay an entire bill in one go, you will be eligible for 1% cashback. What makes it worth it? Well, here, you don’t receive some useless points or vouchers and coupons; the cashback is real. E.g., If your bill is INR 30,000 and you’re paying it off in one go, you’d be eligible for the cashback of INR 300, and you’d need to pay INR 29,700 only.

How to sign-up for Uni Card?

Now the question is, how can you sign-up for Uni Card? Neither have any physical branch nor have I heard anyone receiving calls from their executives offering a credit card. The process is, however, straightforward. They have an app for Android and iOS, and that’s everything you need to apply. Download the app, fill in your data (PAN card, Aadhaar card, address, etc.) and shoot. The app claims to provide a credit limit of anywhere between INR 20,000 to INR 600,000, but I have not found anyone receiving a credit limit of more than INR 100,000 initially.

Uni Card App Experience

As a surprise, I was able to use the credit card immediately after finishing the KYC process. The card number, CVV, expiry date, and all card permission controls are available right away within the app. For once, I felt like I did not need the physical card to arrive at all. The app is super easy. If you’ve ever used any banking app, then you won’t need more than 10-15 minutes to get used to it.

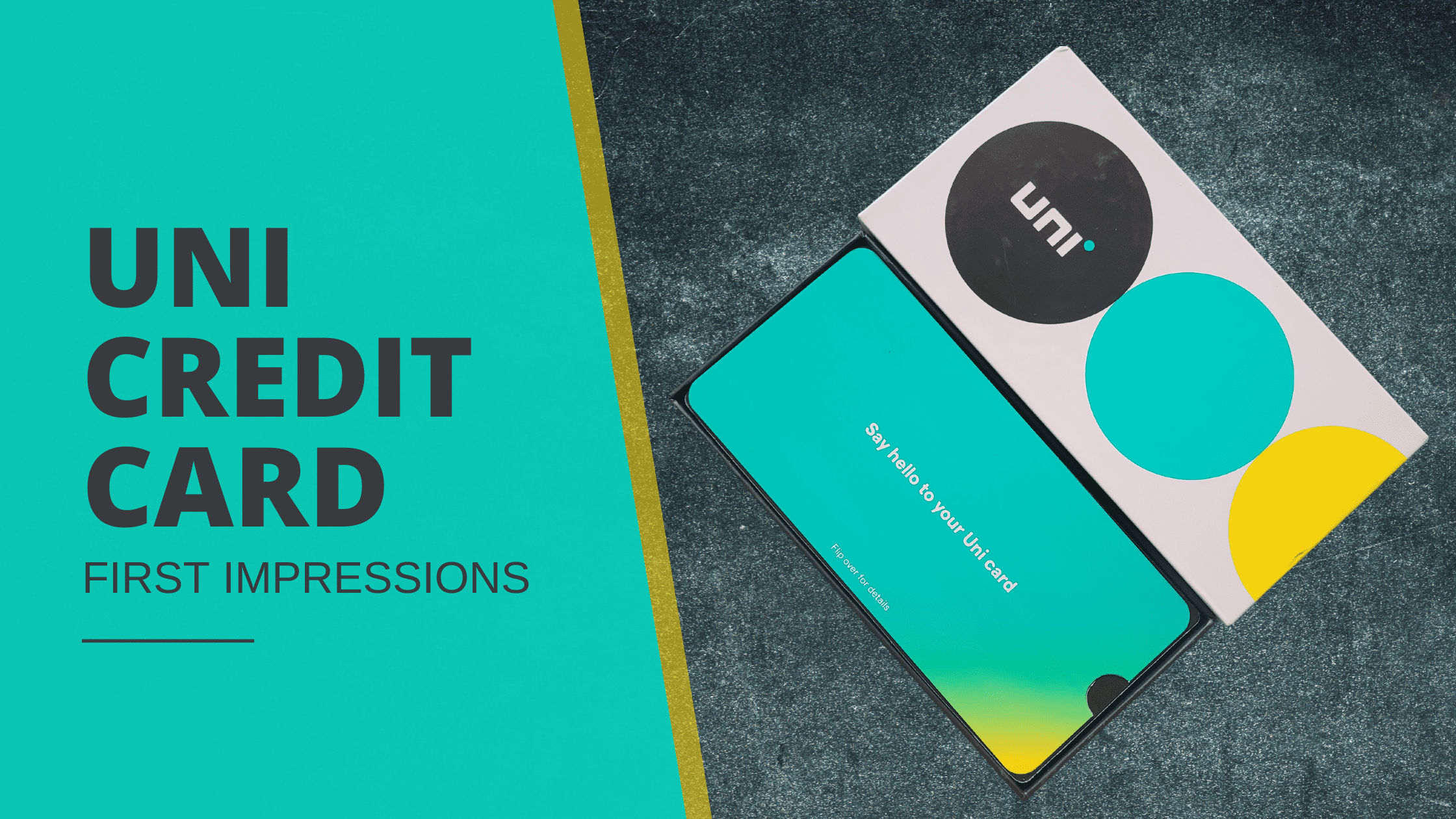

What’s in the package?

Uni wants to stand out from all the other credit cards, and they have stretched the idea till the packaging. While we receive bank credit cards in an envelope with a lot of paperwork, Uni has decided to change the orthodox packaging. The box is like a smartphone, and the unboxing experience remains as exciting as unboxing a new smartphone. It contains a welcome card, a mask (thanks to COVID), a chocolate (which you should throw away), a tag with Uni branding and your name, and of course, the card itself.

This doesn’t end here. The card looks classy with minimum design. There’s nothing too fancy about it. But, unlike many other credit cards we see, the card number and expiry date are not on the front. All confidential details about credit cards find their place on the backside.

But, where’s the customer support?

I don’t know how many of you care about customer care, but I do. I check customer support of any company I’m buying. Uni customer support is primarily on WhatsApp. There’s no automation, no IVR-like system but actual human interacting with you on WhatsApp. Just in case you’re not happy with WhatsApp support, you can dial Uni Card customer care at +918068216821. So far, my experience with their customer support is satisfying. I hope they remain this good for a long time.

Is it all good with Uni Card?

Just like any other product, Uni Card isn’t perfect. There are a few things you should consider before applying. First, you need to have a CIBIL score of 700 or above to be eligible for a Uni Card. Secondly, I am unable to turn on offline or contactless payment on this card. And last but most important, many companies like Google don’t accept Uni Card, and there’s no clarity of any support in the future.

Update: I found an option to enable offline and contactless payment. Once you receive the physical card, search for the PIN set option on the home page of the Uni app. You’ll be able to control offline and contactless payments after that.

To conclude, Uni Credit Card can be a great tool if used wisely. However, a mandatory CIBIL score of 700+ can be a barrier for many. This card is yet to be accepted by many companies which you should keep in mind. But when it comes to being a useful product and rewarding customers, it ticks all boxes.

Find more of my blogs here!